Musk's Grok-1, Microsoft's AI Leap

20 March 2024: Elon Musk open-sources Grok-1; Microsoft hires Inflection AI founders; AI funding hits $50B with M&A dip; Saudi plans $40B AI investment

Hey Morning,

Latest in AI,

1-Minute Roundup

Elon Musk's xAI will open-source the 314B parameter AI model, Grok-1, amidst legal battles.

Microsoft recruits DeepMind/Inflection AI co-founders for its consumer AI division, signalling a strategic AI push.

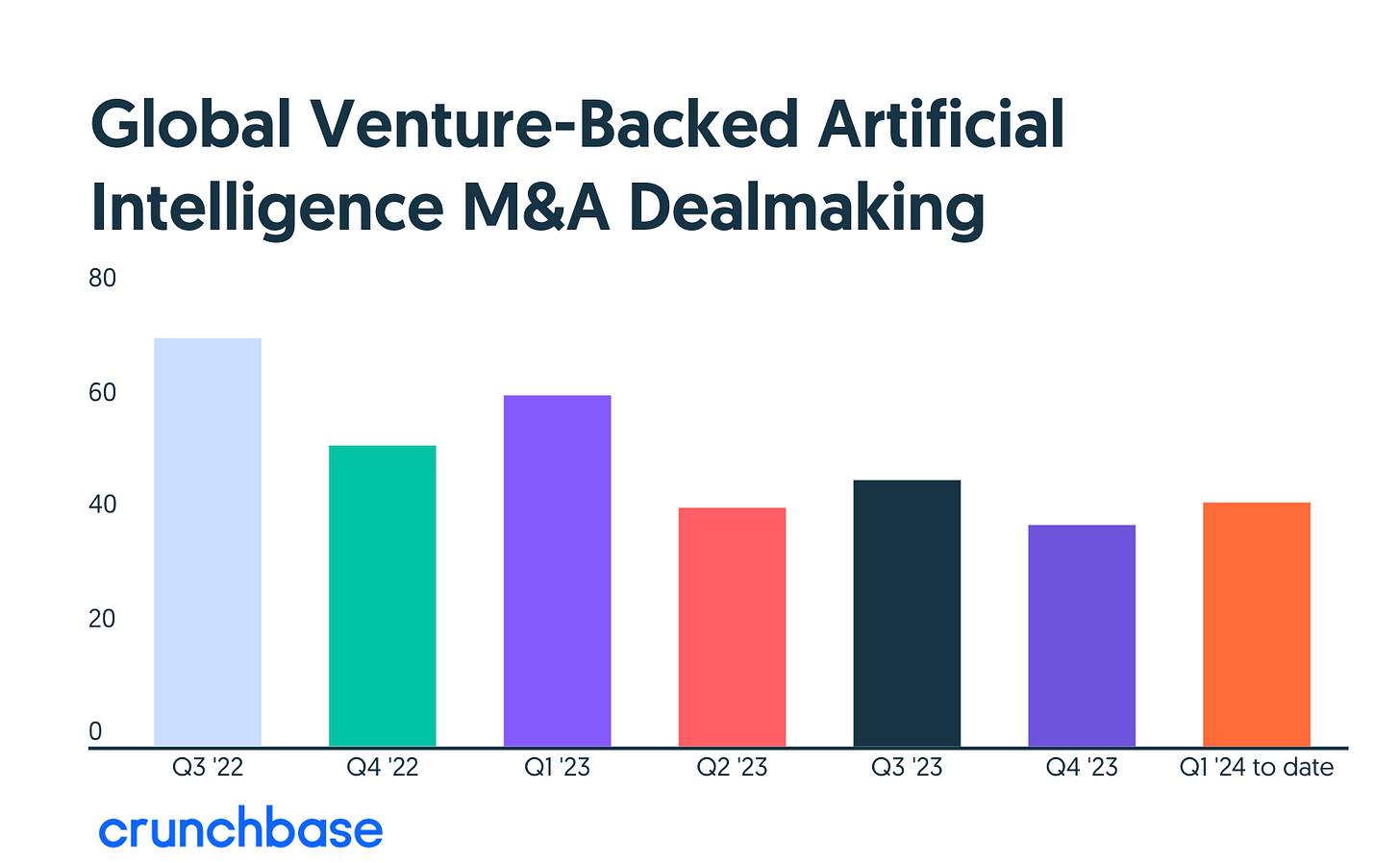

AI venture funding soared to $50B last year despite a 31% drop in M&A deals to 190 in 2023.

BigID raises $60M, valuing the company over $1B for AI-augmented data security.

Blitz Electric Mobility secures $1.6M for AI-driven EV logistics in Indonesia.

OpenMeter's $3M seed round to enhance real-time data integration.

Quilt and Superlinked closed $9.5M seed rounds for AI software development.

Nvidia invests in Ubitus KK for AI enhancements in cloud gaming.

Xaver raises €5M for AI efficiency in insurance & pension.

Innatera nets €15M Series A for neuromorphic AI chips.

Beatoven.ai lands $1.3M for AI music creation.

NeuReality's $20M funding to optimise AI data centres.

Deepthink.ai's Series A+ round for AI night vision tech.

Sensor Tower acquires Data.ai to expand app analytics.

Indian Army forms STEAG for AI and quantum tech in defence.

OpenAI aims for chip independence with significant UAE investment.

Saudi Arabia's $40B AI investment to diversify the economy.

Google Health uses AI to provide better access to health information.

Denmark and NVIDIA will open an AI innovation centre with a DKK 700M investment.

UK AI startup funding shows a gender gap of 0.7% for women-led ventures.

Headlines

Musk Opens Grok Amid Controversy: Strategy or Altruism

Elon Musk's xAI open-sources the “base model weights” and “network architecture” of the “314 billion parameter Mixture-of-Experts model, Grok-1, amid legal battles. While Grok's open-source release could enhance developer freedom, scepticism remains regarding Musk's motivations.

Open-Source Grok: Grok will be available under Apache 2.0, offering notable freedom but not the complete openness seen in models like OLMo, Pythia & Bloom. It also lacks comprehensive resources like training codes and datasets.

Musk's Motivations: The move comes amid Musk's lawsuit against OpenAI, suggesting potential PR motives behind making Grok open source rather than committing to AI for humanity's benefit.

Grok and Twitter/X Premium: Despite its open-source status, Grok's tie to X Corp's premium subscription raises questions about the genuine intent of Musk's decision and its impact on the AI community.

Microsoft Bolsters AI Division with DeepMind/Inflection AI Talent

Microsoft enhances its AI strategy by bringing $4 billion Inflection AI's co-founders, Mustafa Suleyman and Karén Simonyan, to lead its new consumer AI division, promising fresh momentum in AI product innovation and research.

Leadership: Mustafa Suleyman, an AI industry veteran, joins Microsoft to direct the consumer AI sector, with Karén Simonyan as chief scientist.

Strategic Move: This acquisition follows Microsoft's previous investment in Inflection AI, highlighting a strengthened partnership and shared vision in AI advancements.

Impact: Suleyman's role emphasises enhancing AI-driven features in Microsoft's Copilot, Bing, and Edge, aiming to elevate the consumer experience.

AI's Funding Frenzy Clashes with M&A Chill

Despite AI venture funding soaring to $50 billion last year and high-profile IPOs like Astera Labs targeting $534M, AI M&A activity has cooled, with a 31% drop to 190 deals in 2023 from 276 in 2022. The bustling investment scene contrasts sharply with a cautious M&A market, hinting at valuation challenges and potential market saturation by tech giants.

Venture Vibrance vs. M&A Mellow: AI startups enjoyed robust funding, but the expected M&A exit path lagged, with the slowest pace since Q1 2019 in the last quarter of 2023.

High-Profile Deals: Notable acquisitions, such as Databricks' $1.3 billion buyout of MosaicML and Thomson Reuters' $650M purchase of Casetext, stand out amid sluggish deal-making.

Market Dynamics: Investors wary of peak valuations may be causing the M&A slowdown, with concerns that established players like Google and Microsoft might dominate, limiting startup exits.

AI Deals

BigID, an AI-augmented data security firm, has raised $60M in a growth round led by Riverwood Capital. This brings its total funding to $320M and valuation over $1B.

Blitz Electric Mobility, an Indonesian EV logistics company, raised $1.6M in an oversubscribed seed extension round, bringing its total funding to $2.6M, to accelerate its AI and EV logistics expansion across Indonesia.

OpenMeter raised $3M in a seed round from Y Combinator, Haystack, and Sunflower Capital to standardise a managed cloud service and an open-source metering platform for real-time data processing and integration.

Quilt announced a $9.5M Seed funding round led by Sequoia Capital to enhance AI software solutions for "B2B sales professionals".

Superlinked raised $9.5M in Seed funding, led by Index Ventures and Theory Ventures, to enhance its "vector computer" technology for real-time personalised software development.

Ubitus KK secured undisclosed funding from Nvidia to enhance its cloud gaming technology and AI solutions across various sectors, leveraging their collaborative efforts on GPU cloud infrastructure.

Xaver, a German fintech startup, raised €5M in a pre-seed round for its AI platform targeting life insurance and private pensions, aiming to enhance efficiency by up to 65% and tackle Europe's pension gap.

Innatera, a Dutch neuromorphic AI chipmaker, has raised €15M in a Series A round led by the EIC Fund, with contributions from Invest-NL Deep Tech Fund and others.

Beatoven.ai, an AI music startup, raised $1.3M in a pre-Series A round led by Capital 2B.

NeuReality, an Israeli startup, has raised $20M to enhance the efficiency of AI data centres. NeuReality will enable cheaper and faster-gen AI applications and LLM operations by avoiding excessive investment in underutilised GPUs.

Deepthink.ai secured an eight-figure RMB sum in a Series A+ funding round from King Tower Capital for R&D and market expansion of its AI-based night vision solutions.

Sensor Tower has acquired rival Data.ai to expand its customer base, including brands like Microsoft and Bandai Namco, and enhance its data accuracy and product offerings.

We review over 150+ data/news feeds daily to provide FREE AI insights. If you’re already subscribed and/or appreciate our work, spreading the word or simply hitting the LIKE button is one of the best ways to support us.

Others

Indian Army Launches STEAG for Advanced Tech Research

The Indian Army has established the 'Signals Technology Evaluation and Adaptation Group' (STEAG) to explore and integrate cutting-edge technologies like AI, 5G/6G, and quantum computing into defence operations.

Aiming to enhance military communication and operational capabilities through collaboration with academia and industry

OpenAI's Strategic Move Towards Chip Independence

OpenAI collaborates with a UAE investment firm, aiming for a significant investment between $5 trillion and $7 trillion to develop AI chips, reducing dependence on Nvidia's limited H100 chips.

Facing challenges in design and manufacturing, OpenAI's venture into creating its own AI processors is a long-term play against the current reliance on AMD, Intel, and Nvidia.

Saudi Arabia's Ambitious Leap into AI Investment

Saudi Arabia plans to invest $40 billion in AI, collaborating with top financiers like Andreessen Horowitz to diversify its oil-dominated economy and enhance its global influence in the tech sphere.

Google Health's AI-Driven Innovations for Accessible Health Information

Google Health is leveraging AI to enhance access to health information, introducing features like visual search through Google Lens for skin conditions and enriched search results with images for understanding symptoms.

Collaborations extend to YouTube and Fitbit, offering AI-powered tools for content translation and personalised health insights to bridge language barriers and provide customised health data analysis.

Denmark's Leap into AI Innovation with NVIDIA Partnership

Denmark collaborates with NVIDIA to launch a national AI innovation centre. The centre will house a leading-edge AI supercomputer backed by a DKK 700M investment from the Novo Nordisk Foundation and EIFO.

The Gefion supercomputer, featuring 191 NVIDIA DGX H100 systems powered by 100% renewable energy, aims to propel Denmark into the forefront of AI research and application across various sectors.

AI Investment Surge Overlooks Female Founders

A mere 0.7% of UK AI startup funding since 2010 has gone to women-led ventures, highlighting a significant gender gap in the booming AI sector, as the Alan Turing Institute reported.

Initiatives like the Invest in Women Taskforce aim to address the urgent need for diversity in investment practices within the tech industry.

Love the AIML newsletter? Please share it with your friends, family, and colleagues who want to stay on top of AI. I hope you have a great day. Follow us.